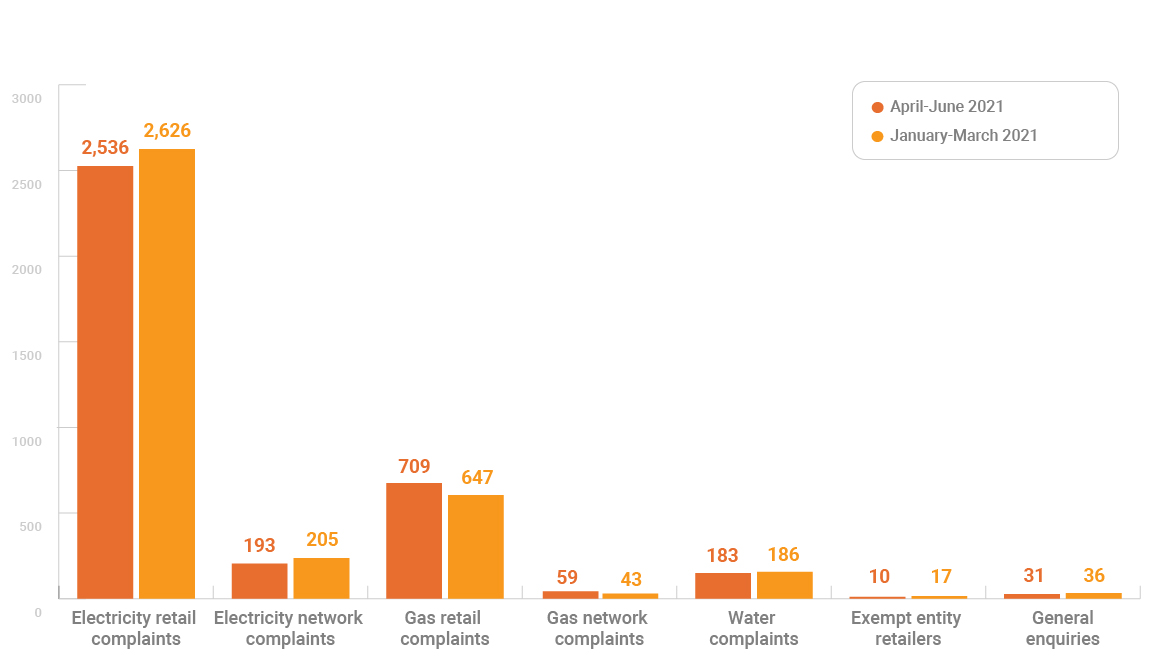

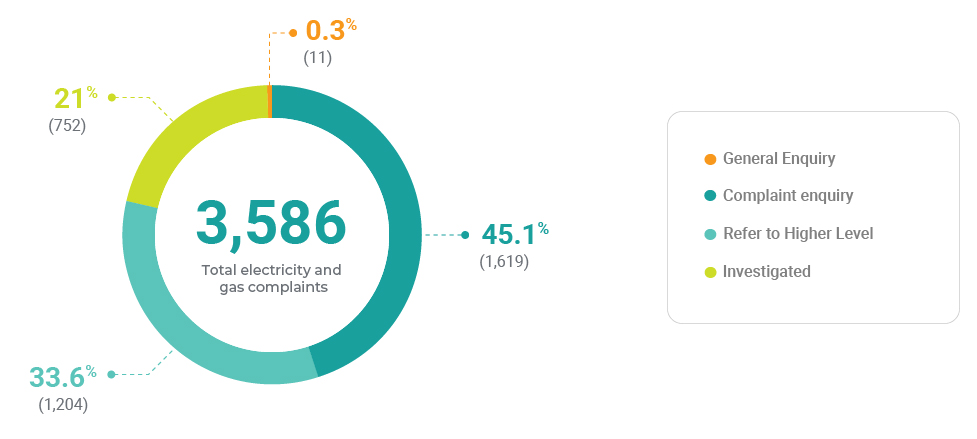

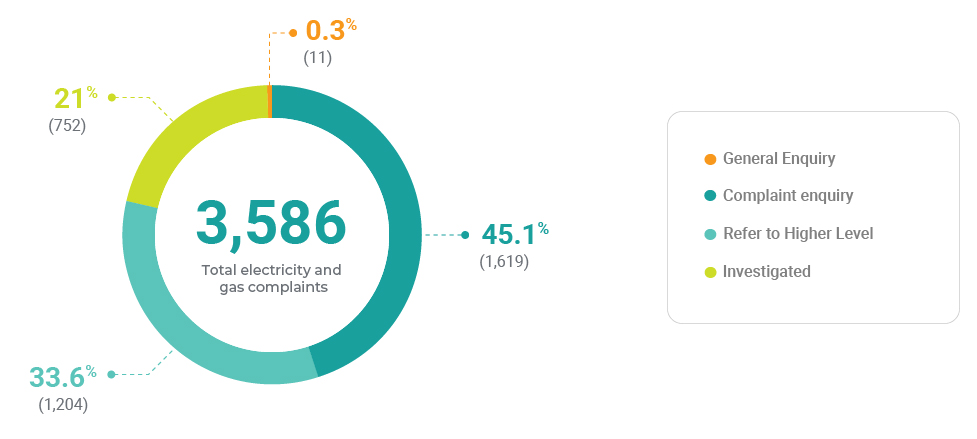

3,586 electricity and gas complaints were received in April-Jun 2021. The breakdown of energy complaints by complaint category is shown in the graph and Table 4 below.

Table 4 – Energy complaint breakdown April - June 2021

| Complaint type |

Number of complaints |

% total energy complaints |

| General enquiry |

11 |

0.3% |

| Complaint enquiry |

1,619 |

45.1% |

| Refer to higher level |

1,204 |

33.6% |

| Investigated |

752 |

21% |

| Total |

3,586 |

100% |

Case studies

Debt collection

The AER’s Statement of Expectations ensured debt referral to credit collection agencies was deferred during COVID-19, provided customers contacted their retailer or set up affordable payment plans.

However, EWON saw cases involving financial vulnerability increase during 2020 and 2021, including a wide range of complaints regarding debt being referred to credit collection agencies.

Retailer won’t agree to affordable repayments

A customer was contacted by her retailer regarding a debt of $244 on a closed electricity account. She was aware of the debt and was paying $10 per fortnight since the account was closed. The retailer told her that she needed to pay the $244 as a lump sum or the debt would be referred for credit collection. She said she was unable to make this payment due to other financial commitments and offered to pay $25 upfront and then $50 per fortnight. The retailer declined and did not provide an explanation why they had requested a lump sum payment. She asked the retailer to send her a copy of her account statement but it was never received.

EWON contacted the retailer which offered to waive the balance of $244. The customer was happy with the outcome.

Retailer unable to provide proof of debt

A customer was contacted by a collection agency about a $687 debt for a property he had moved out of in September 2019. He said the amount owing did not reflect his normal usage and the retailer had not closed the account when requested. He was told that the debt had been sold and the retailer could no longer discuss the account with him. He requested a copy of the final bill, but it was never sent to him.

We referred the customer to the retailer at a higher level, however, the customer returned to EWON after the retailer failed to provide a copy of the bill as it was too old. They also offered the customer an $11 credit, the amount they considered the account was overcharged. He offered to pay the retailer 30% of the debt, but this was declined. He wanted the retailer to provide proof of the debt, including information about the date that the account was closed.

The customer explained to EWON that he had recently experienced financial vulnerabilities, including periods of homelessness. He said he had a limited capacity to pay due to ongoing health issues, however he did want to pay something towards the debt. He had also seen a financial counsellor with the view to being placed on the National Hardship Register.

When EWON began an investigation, the retailer recalled the debt from the collection’s agency, however advised that it considered the account balance to be correct due to an accumulation of arrears and the customer only ever making one payment towards the account. In recognition of the customer’s vulnerable situation, the retailer agreed to the customer’s proposed resolution to pay 30% of the account balance ($206) and waived the remaining $481 to resolve the complaint.

Overseas customer unable to close energy account

A customer had been overseas between May 2020 and April 2021 and was unable to return to Australia due to COVID-19 restrictions. While overseas, he was unable to access his bank account to pay his bills as he was living in a country subject to financial sanctions. He contacted the retailer to close the account and requested a payment extension for when he returned to Australia. The retailer told him he needed to call them to request an extension every few weeks, but this was too expensive. When back in Australia, he contacted the retailer to request they waive any fees but was told that the debt had been referred to a collection agency and it could no longer assist him.

When EWON commenced an investigation, the retailer confirmed that the account had been closed and that no late payment fees had been applied to the account. The retailer also confirmed that the debt had not been sold and recalled it from the collection agency.

To resolve the complaint, the retailer applied all missed Pay on Time discounts reducing the account balance from $1,267 to $1,075 and applied a further credit of $175 to the account. This reduced the account balance to $900, and the customer was offered 12 months to pay the remaining debt.

Debt collection activity after advocate unable to close account

An advocate contacted EWON on behalf of a customer who was unable to speak due to ongoing health issues. The customer was vision impaired, had recently undergone surgery relating to his vision and was unable to read. The customer wanted to close his account as he left his property in February 2021 and was now homeless.

At first, the retailer told the advocate that the account could not be closed without the customer’s authorisation, refusing to consider the customer’s circumstances. The retailer eventually agreed to close the account and issued a final bill to the customer for $308. The customer previously had a payment arrangement of $70 per fortnight, however could not afford to keep paying that amount and offered to pay $20 per fortnight. The retailer refused to provide a payment arrangement for the final bill.

The retailer also tried to insist the advocate should take responsibility for the account. She did not think this was appropriate and refused, and. The debt was sent to a collection agency for recovery. The advocate was not satisfied with the customer service she received and contacted EWON for assistance.

EWON contacted the retailer who confirmed that while the advocate was listed as an authorised person on the customer’s account, she was not authorised to make changes to the account such as closing it or set up payment arrangements. The retailer acknowledged that the customer had not been able to contact them to discuss a payment arrangement given his circumstances and offered to recall the debt and waive the balance of $308. The advocate was happy with the outcome.

Transferring or opening account results in disconnection

Disconnections are always stressful for customers, but they can be even more frustrating when the customer has been transferred to another retailer in error, resulting in a disconnection order being issued by a retailer the customer has no relationship with.

Electricity disconnected after billing rights error

A customer had an electricity account with Retailer A, but was disconnected by Retailer B in June 2021. Retailer B told her there had been an error but could not explain further. She contacted EWON for assistance with reconnection and to find out why her electricity had been disconnected by Retailer B, a retailer she didn’t have an account with. We confirmed with Retailer B and the distributor that the reconnection was in progress and supply was reconnected on the same evening.

Our review found that Retailer B had taken over the billing rights for the customer’s address in error in September 2020. An administrative address error when opening an account for a different person meant the customer’s address was taken over by mistake. This was in part because the address for the customer’s electricity meter in Retailer B’s system was not consistent with the address in the national electricity database. Despite realising the error and closing the account opened in error, Retailer B did not return the billing rights to Retailer A. Retailer B then began sending vacant consumer bills, but the customer had not received them because the address was incorrect.

Following EWON’s involvement, Retailer A won back the billing rights in June 2021. Retailer B corrected the address in its system to match the national electricity database, waived the $833 in vacant consumer charges and offered a goodwill credit of $100. The customer accepted this outcome as resolution of the complaint.

Delayed transfer due to faulty meter

A customer opened an electricity account for her new address with Retailer A in November 2020. She received a welcome pack in February 2021, but did not receive any further bills or notices until she received a disconnection warning in May 2021.

Retailer A advised her that it had not send the disconnection warning, as it had not been able to open an electricity account as there was something wrong with her meter box but could not explain in more detail. The customer didn’t know who sent the disconnection warning so was unable to contact the retailer who owned the billing rights.

EWON’s review found that Retailer B held the billing rights for the site. Retailer B had sent vacant consumption notices and arranged disconnection as these had not been responded to. Retailer A had made multiple attempts to transfer the site, but these were rejected by the network due to a faulty meter meaning it was impossible to obtain an actual meter reading.

The customer agreed to establish an account with Retailer B and was reconnected. Retailer B confirmed that she would not be billed for electricity from November 2020 to 2 June 2021 as a goodwill gesture. Retailer B then arranged for the customer’s basic meters to be replaced with a digital meter. Once the meters were replaced, the customer could then decide whether to remain with Retailer B, transfer to Retailer A or transfer to another retailer of her choice.

Gas disconnected after confusion with address and meter

A customer opened a gas account with Retailer A for her new address in May 2020. She received and paid gas bills from Retailer A, but also received letters about the gas from Retailer B addressed ‘To The Occupant’. At one point a field officer attended to disconnect the gas supply but agreed to hold off so she could contact the retailers. She contacted Retailer A about the letters and near disconnection, and Retailer A advised that her account was set up correctly and there should be no issue. The gas supply was then disconnected in March 2021. When she contacted Retailer A, it advised there was confusion with the address. She then contacted EWON as it was unclear what had gone wrong or whether Retailer A had arranged reconnection.

EWON found that Retailer A had set up the customer’s gas account for an incorrect gas meter. Retailer B owned the billing rights for the customer’s correct gas meter and had disconnected for vacant consumption. The customer set up a gas account with Retailer B and the gas was reconnected on 29 March 2021.

Retailer B backdated the start of the customer’s account to October 2020 and advised the customer would not be charged for gas use from May 2020 to October 2020 as a goodwill gesture. The customer decided to stay with Retailer B rather than transferring to Retailer A. Retailer A cancelled the customer’s account and refunded the payments of $247 made to the account for the wrong address. The customer accepted this outcome.

Retailer unable to establish a gas account then disconnects gas

A customer opened a gas account for his new address with his preferred retailer in February 2021 but was then disconnected in April 2021. The customer contacted his retailer, which said it had not opened a gas account or initiated a transfer. His retailer said it had now opened an account and requested reconnection. The customer contacted EWON as he was unsure if the reconnection would go ahead and wanted a review of what had gone wrong when he tried to open the account.

EWON confirmed that the retailer already had the billing rights for the customer’s address so there was no need to request a transfer. The retailer had been unable to locate the customer’s address when trying to establish a gas account as it was recorded in the gas network database in a slightly different way to what the customer supplied. Despite this, the retailer had not followed up with the customer to obtain a physical meter number or clarify the address.

EWON confirmed with the retailer and the distributor that the gas reconnection was already raised, and the customer confirmed the gas was reconnected the following day. The retailer backdated the customer’s account to 12 February 2021. Given the issues establishing the account and the customer being without gas overnight, the retailer waived $355 for the period 12 February 2021 to 2 March 2021 and applied a goodwill credit of $250. The customer was happy with this outcome.