-

Home

-

Publications and submissions

-

Reports

-

Spotlight On

- Consumer and small business energy debt solutions

Consumer and small business energy debt solutions

November 2021

“COVID has left a scorched economic path, particularly in areas that were more disadvantaged pre-pandemic. In so many communities, we are leaving people behind.” Dr Cassandra Goldie, CEO, ACOSS1

After benefiting from temporary protections during the pandemic, small business owners and customers with closed accounts are now joining those disadvantaged communities. This is despite the combined debt for both groups increasing significantly during COVID-19.

In April 2020, the Australian Energy Regulator (AER) announced its Statement of Expectations, which provided temporary measures to delay debt collection and ensured energy customers could negotiate payment arrangements during the pandemic. For the first time, the energy sector provided a mechanism for protecting customers with a closed energy account (i.e. those who have moved property or transferred retailers), and small business customers.

The final iteration of the Statement of Expectations, protected NSW customers during the latest lockdown, and ended on 25 October 2021 removing the temporary bandaid of protections for closed account and small business account holders.

While the temporary measures in place during the pandemic assisted customers, the unintended consequence was an increase in overall debt levels. According to the AER, between March 2020 and March 2021:

- The combined debt for NSW residential accounts has increased to nearly $97 million, a 32% increase in just one year.

- The combined debt for small business accounts has increased to $32 million, an increase of 42%.

While the temporary protections have lifted, customers with active residential accounts are still protected under the National Energy Retail Law (NERL) and the National Energy Consumer Framework (NECF).

Meanwhile, customers with closed energy accounts and small business customers have returned to the pre-pandemic framework with limited protections, despite operating in an economic environment that is more vulnerable than before.

EWON is calling for retailers and government to implement processes or regulations to ensure equitable protections for these customers, and encouraging consumers and retailers to work together to pay off COVID-19 related debt

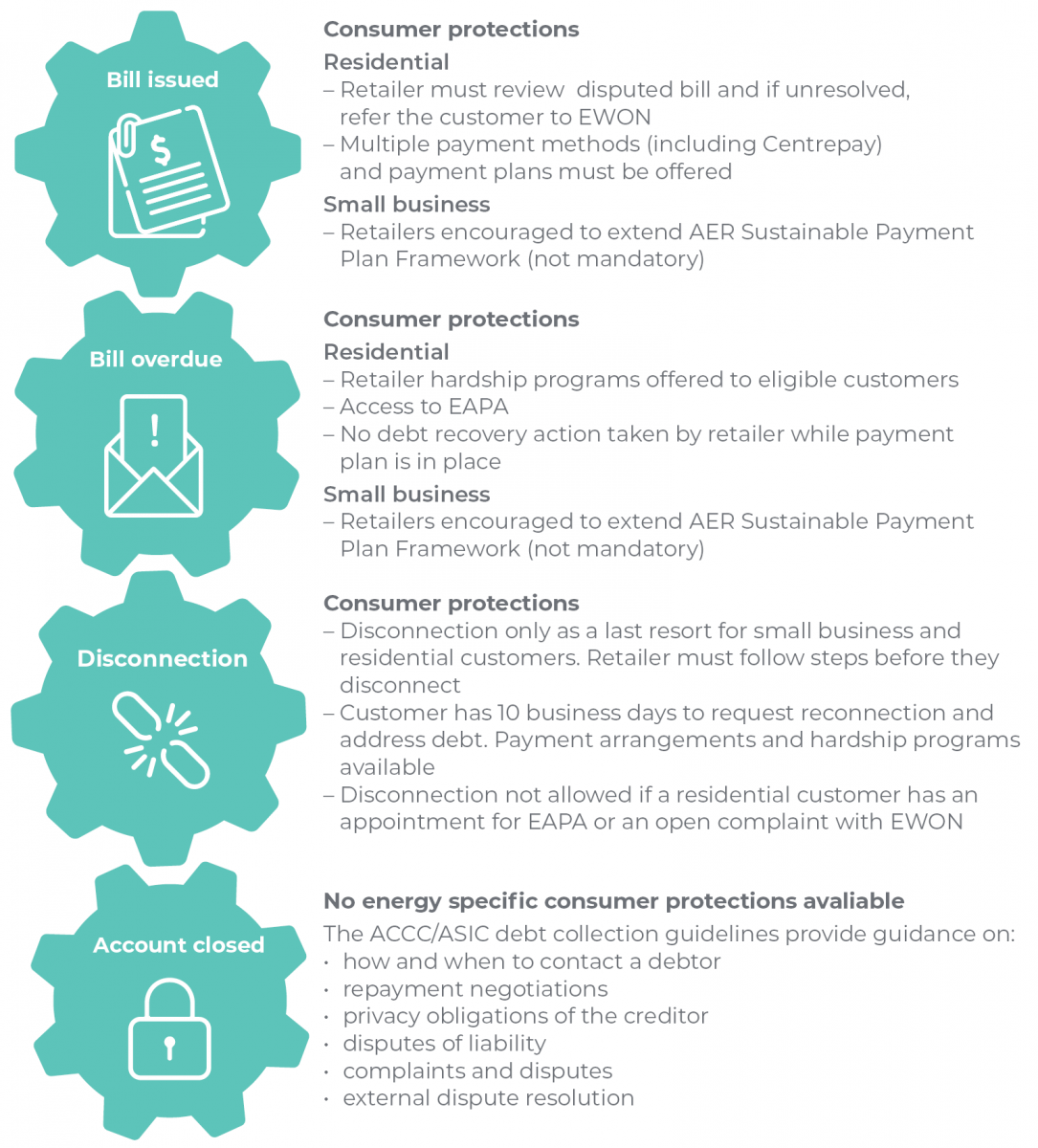

The energy collection cycle

Who can access consumer protections?

| Consumer protections | Residential customer of authorised retailers | Customers with closed accounts | Business customers of authorised retailers |

|---|---|---|---|

| Hardship policy approved by the AER |  |

|

|

| Hardship programs |  |

|

|

| Payment arrangements |  |

|

|

| Protection under AER Sustainable Payment Plan Framework |  |

|

|

| Centrepay payment arrangements |  |

|

|

| Energy Accounts Payment Assistance |  |

|

|

| Information about internal and external dispute resolution |  |

|

|

| Contract details of EWON before and at the time of disconnection |  |

N/A |  |

| Access to EWON |  |

|

|

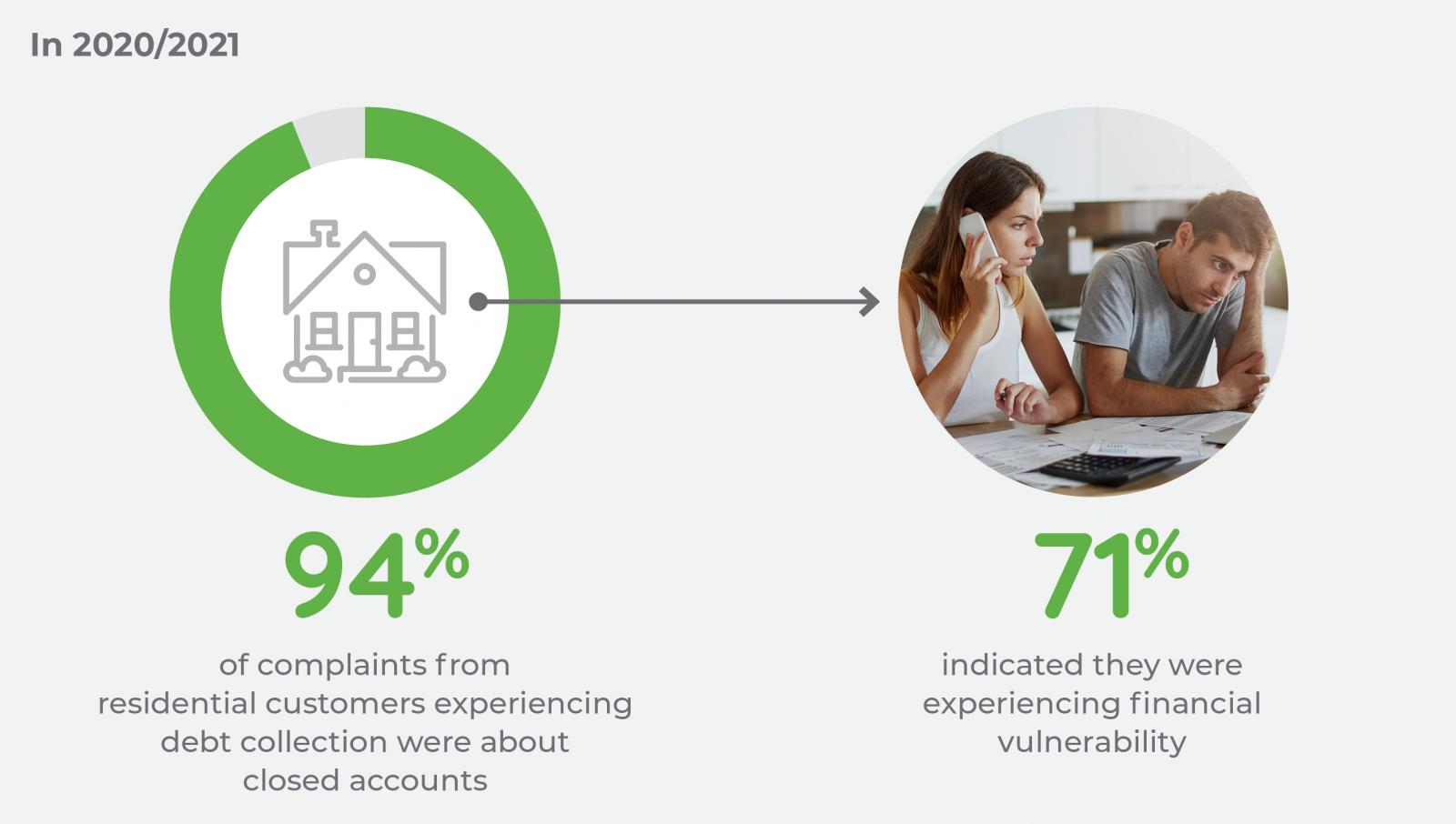

Closed accounts

Customers usually open and close accounts when moving in or out of a property or transferring to a different retailer for a better deal. Treating all closed accounts in a similar way does not take into consideration the range of circumstances customers face.

Currently, if an energy customer is no longer actively being provided a service by the retailer, it means that the retailer has no further responsibility to assist that customer – even though the retailer’s practices may have contributed to accumulated debt. This needs to be questioned. Customers who are experiencing financial vulnerability and close their electricity account will continue experiencing financial vulnerability and will need assistance in dealing with that debt.

NECF, the National Energy Consumer Framework is designed for customers experiencing short to medium term financial vulnerability. It does not provide assistance for consumers that face long term financial difficulty. It also means that these customers are faced with the long term impacts of collection activity and default listing if they miss payments or close their accounts.

When an account is closed, both the customer and the retailer need to be accountable for any arrears on the account. Engagement between both parties is necessary to empower customers to work towards financial stability. By applying affordability protections and payment plans to closed accounts, customers would be encouraged to pay off debt and also have the opportunity to transfer to better energy deals.

The AER’s Statement of Expectations required payment plans to be offered for closed accounts, and EWON’s complaint data shows how this temporary protection worked for the customers who reached out to EWON for assistance which was not initially provided by their retailer.

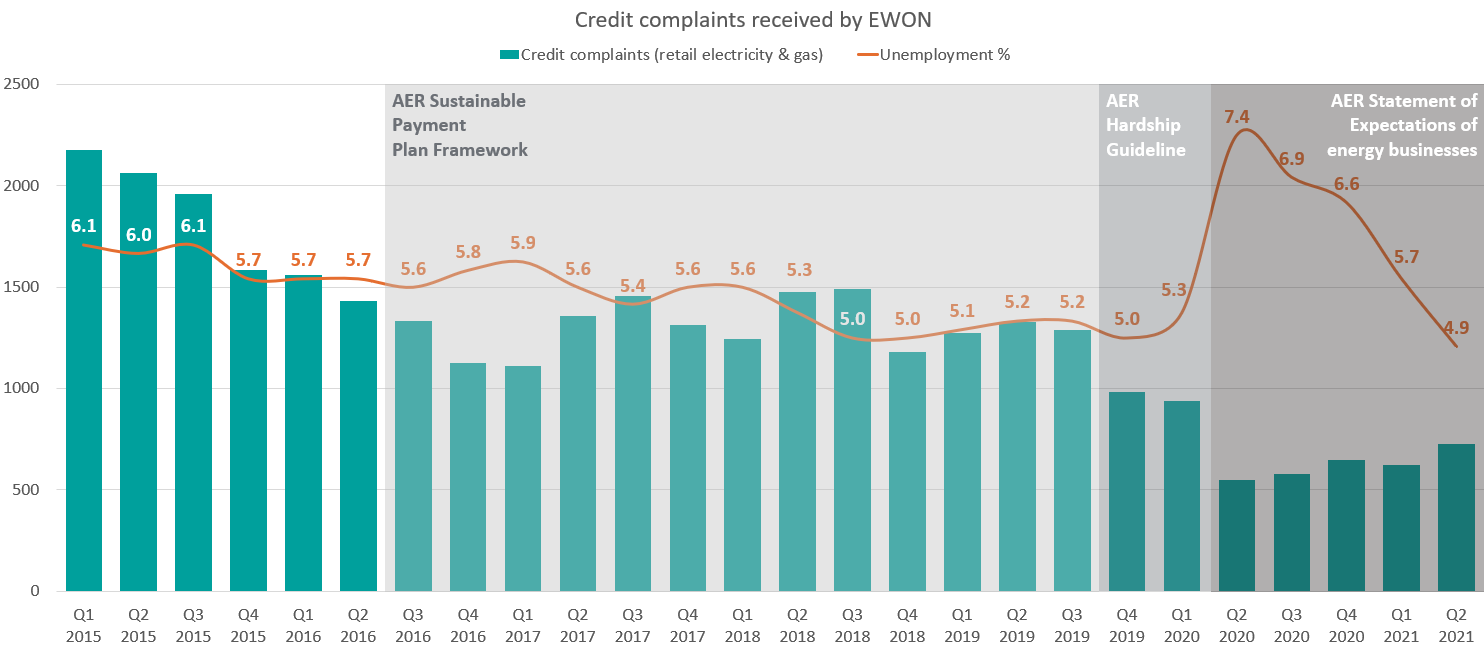

We have seen a reduced number of credit complaints, as a result of the Statement of Expectations.

It is likely that with the end of COVID restrictions, a large number of accounts will soon enter the collections cycle or retailers will sell the debt to assist them in their own financial recovery from the pandemic.

If affordability programs and payment plans for closed accounts were continued, customers entering the debt collection cycle would be minimised, while allowing retailers to recover funds. And that increase in complaints will be avoided.

Further, if a more flexible approach to the management of closed accounts were adopted, it would encourage better engagement, reduce stress levels, and reduce the stigma associated with protracted ‘chasing’ from debt collection agencies.

The following case studies highlight that with continued engagement and flexibility from retailers, customers with closed accounts can commit to pay off the balance of the account while continuing to manage their ongoing finances. This approach prevents long term financial hardship and presents a ‘win win’ solution for both parties.

Case study: Retailer grants affordable payment plan for closed account

Case study: Retailer grants affordable payment plan for closed account

A customer closed her electricity account in August 2020 after receiving bills for over $1,000 per quarter for the previous year. She transferred her electricity account to a new retailer that offered lower rates.

She had contacted her previous retailer on several occasions to question the high bill, however had only been offered payment plans and the account had also been rebilled several times since she had closed the account.

The account had a debt of over $1,500 and she was experiencing financial vulnerability due to loss of income caused by COVID-19 and she had found her previous payment plan difficult to manage. The retailer had sent her notices regarding future credit action, and she was concerned about the impact on her credit rating.

EWON contacted the retailer, and the customer was offered a good will gesture of $500 towards the account and a payment plan of $80 per fortnight to pay the balance.

The customer was happy with the outcome as the amount was affordable and her credit rating would not be affected.

Case study: Customer and retailer engagement pays off

Case study: Customer and retailer engagement pays off

A customer owed $1,780 towards a closed electricity account and had established a payment arrangement of $25 per week with the retailer. He was impacted financially by COVID-19 and was not able to work. In June 2020, he altered his payment arrangement of $10 per week.

His retailer then offered him a 30% discount off the total debt if he was able to pay the amount in full. He could not afford this so he asked for the $10 per week payment arrangement to continue. He was then contacted by a credit collections agency, seeking full payment of the account.

EWON contacted the retailer which offered to continue the payment arrangement of $10 per week. The retailer encouraged the customer to pay more, where possible and for the customer to remain engaged with the retailer regarding payment of the account and their capacity to pay the debt.

Case study: Customer transfers account to limit ongoing debt

Case study: Customer transfers account to limit ongoing debt

A customer on the disability pension received higher than expected electricity bills and due to COVID-19 impacting his family income was unable to pay his bills on time.

When he contacted his retailer, he was placed on a payment plan. He was unsure whether he was receiving rebates or if the retailer had placed him on its payment assistance program.

To avoid further high charges, he transferred his electricity account to a retailer with cheaper rates. He was then contacted by a collection agency seeking $847. He wanted to pay the arrears, but was unable to pay the amount in full.

The retailer advised EWON that the customer had previously been on its payment assistance program and had received the appropriate rebates, however this had been cancelled when the customer had closed his electricity account.

The retailer established an affordable payment arrangement with the customer of $60 a fortnight towards his closed account. The retailer also advised EWON that the customer had an active gas account with them, which also had a balance owing. EWON provided the customer with referrals for EAPA and a financial counsellor.

Small business accounts

The current consumer framework provides some protections for small business customers that use less than 100 MWh per annum or less than 1 TJ of gas per annum. This includes a broad range of business types, with very different annual turnovers and profit margins.

The pandemic and lockdowns impacted some small businesses significantly more than others.

Removing the temporary protections places a large number of small business customers more at risk of experiencing long term financial vulnerability, or not being able to recover financially from the business loss experienced.

While the framework should not encourage small businesses to trade while insolvent, the majority of businesses would be better placed to pay debt if retailers provided affordable payments plans to assist them.

Even without the COVID-19 stressors of the past two years, complaints to EWON show that small business customers experiences vary in degree of financial vulnerability, whether it be due to natural disasters, personal illness, or other short-term issues.

Some retailers offer payment arrangements but business owners are currently not in a strong negotiating position when requesting an affordable amount arrangement or time period to pay the debt. Like residential accounts, businesses that are engaged, with a genuine intention to pay back, would benefit significantly from the extension of affordability provisions under energy legislation.

Case study: Customer unable to make payments

Case study: Customer unable to make payments

The customer owned a café which he had to close permanently in April 2020. He then experienced a period of hospitalisation following significant health issues and was unable to work. His family were also experiencing a reduction in income due to COVID-19.

He was contacted by a collection agency, for a gas account debt of $1,150. When he contacted the retailer to discuss his current circumstances, he was advised that no payment assistance could be provided on compassionate grounds as the account was a business account.

When EWON contacted the retailer, they offered to waive the balance of the account. The customer was very happy with the outcome.

In the above case study, the retailer went above and beyond to assist the customer during the EWON investigation, however if a framework existed for business customers experiencing affordability challenges, the customer would have been able to negotiate a payment arrangement at an earlier opportunity, and the retailer may have recovered the debt.

It's time to take action

.jpg) EWON recommends: Extension of hardship provisions under the NERL and NERR

EWON recommends: Extension of hardship provisions under the NERL and NERR

Under the NERL, an energy retailer must not commence debt recovery proceedings if the customer continues to adhere to the terms of an agreed payment arrangement, or if the energy retailer has failed to comply with the requirements of the NERL regarding payment plans and assistance. This needs to be extended in the NERL and National Energy Retail Rules (NERR) for closed accounts and small business accounts. In the meantime, energy retailers could voluntarily continue to provide support for closed accounts and small business.

Many retailers are willing to negotiate a payment arrangement for a closed account. However, they are often short, i.e. six to 12 weeks and not sustainable for customers experiencing financial vulnerability. Extension of these consumer protections would assist customers by levelling the playing field.

.jpg) EWON recommends: Extension of the AER Sustainable Payment Plan Framework to closed accounts

EWON recommends: Extension of the AER Sustainable Payment Plan Framework to closed accounts

The AER Sustainable Payment Plan Framework sets a best practice standard for customers and retailers. It encourages meaningful conversations about a customer’s capacity to pay, and aims to achieve better outcomes by helping customers and retailers agree to payment plans that are affordable and sustainable.

The AER retail performance data shows that at the end of March 2020 there were 14,682 deemed residential electricity accounts in NSW. This increased by 59% to 23,303 at the end of September 2020. Small business accounts increased by 43% from 6,011 deemed accounts to 8,614.

Comparing the increase in deemed accounts with the increase in debt, points to an underlying problem. Affordability issues are forcing some customers to close their accounts and move to another retailer to temporarily avoid payments.

If the AER Sustainable Payment Framework was applied in these circumstances, it would encourage engagement and cooperation with closed account customers, knowing they have another avenue to assist in their debt management. Or, if retailers applied the Australian Securities and Investments Commission and Australian Competition and Consumer Commission guidelines as part of their interactions with customers with closed accounts, it would provide an alternative option for customers and retailers to work together so the debt is paid at an affordable rate. It would also prevent retailers from pursuing other avenues to recover debt, such as the sale of debt, often at a reduced rate.

.jpg) EWON recommends: Development of a Retail Code or Best Practice Guidelines for small businesses accounts and closed accounts

EWON recommends: Development of a Retail Code or Best Practice Guidelines for small businesses accounts and closed accounts

The Statement of Expectations was a voluntary guideline that provided temporary protections for small businesses and customers that have a closed energy account.

Retailers were willing to provide these protections to customers, with many retailers offering assistance beyond the scope of the expectations set by the AER.

There is an opportunity to continue the momentum gained from these temporary protections, while recognising the need to balance customer needs with the ongoing commercial viability of energy businesses.

Industry and regulators could develop a mutually beneficial retail code or best practice guideline in dealing with hardship, payment plans and debt collection. This will encourage ongoing engagement and confidence from consumers.

Looking ahead

While complaint numbers relating to credit have decreased over the past two years, it is clear that affordability challenges have increased. Without continued protections it is likely that there will be an increase in credit complaints due to an influx of consumers into the collections cycle.

A framework for closed account and business customers experiencing hardship would enable better outcomes for customers and a decrease in complaints – directly to retailers and/or EWON. Proactive direction of the cost of managing these complaints to instead supporting COVID-19 affected customers makes excellent business sense.

To read more about how the post-pandemic world is going to test energy affordability read our previous Spotlight On – the national affordability framework.

For queries about policy issues raised in Spotlight On, contact Rory Campbell. For media queries contact Fran Strachan.

Footnote:

1 ACOSS media release 4 October 2021