-

Home

-

Publications and submissions

-

Reports

-

Spotlight On

- National Energy Affordability Framework

National Energy Affordability Framework

December 2020

As our federal and state governments consider how and when to wind back economic support for households affected by the COVID-19 pandemic, most industries are preparing for an affordability crisis to develop in 2021. But is the energy sector prepared?

The post-pandemic world is going to seriously test the affordability measures contained within the National Energy Customer Framework (NECF), which is already showing signs of stress.

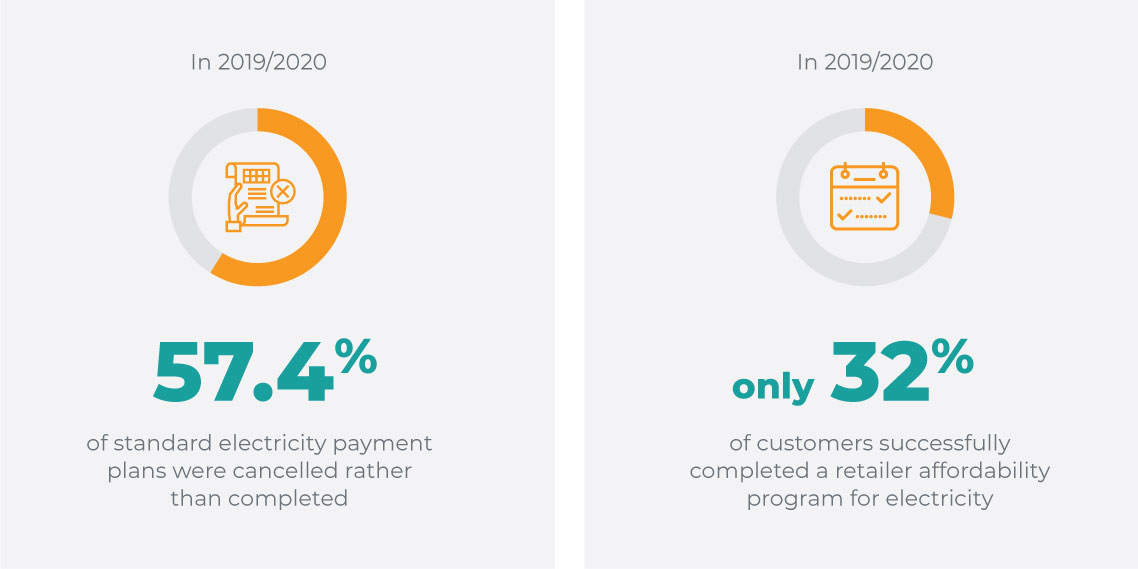

In 2019-20, seven years after the establishment of NECF, it was reported that 57.4% of standard electricity payment plans were cancelled rather than completed1. In the same period, only 32% of customers successfully completed a retailer affordability program2.

One of the Energy & Water Ombudsman (EWON) Charter responsibilities is to identify and resolve systemic issues affecting energy and water consumers in NSW. Our focus is three-fold: reduce complaints; strengthen consumer protection frameworks and ultimately, improve public trust in the energy retail market. Some of our most critical systemic issue work undertaken over the last seven years has focused on groups of customers who cannot access the financial assistance they need – when they need it.

Energy affordability is a complex conundrum. Through our close work with consumers we see individuals experiencing a variety of affordability problems including: circumstantial, cyclic and permanent (lifetime) financial vulnerability. The current framework, on the other hand, has a one-size-fits-all focus; it isn’t designed to respond to these complexities, and therefore, from a regulatory compliance perspective, energy retailers are using tools which are often not fit for purpose.

The basic structure of payment plans can set customers up to fail.

This report focuses on the regulatory gaps in the NECF affordability framework, in particular how the basic structure of payment plans can set customers up to fail. The stark truth is that the affordability protections in the NECF rely on a single cliff-hanger: how effectively a customer completes their first two payment plans. The significant reforms introduced since 2016, including the AER’s Customer Hardship Guideline and the Sustainable Payment Plan Framework, didn’t change the minimum retailer obligations for negotiating payment plans. Further, retailer affordability programs rely, at their core, on payment plan adherence and are therefore affected by the same consumer protection gaps explored in this report.

Our systemic issues work has highlighted a number of broad structural problems with the current affordability framework as contained in the National Energy Retail Law (NERL) and the National Energy Retail Rules (NERR). The scale of energy affordability faced by Australia’s retail energy sector will always be closely linked to external economic conditions, including unemployment, under-employment, and the gig economy’s impact on regular and reliable income.

It is definitely time for the energy industry to rethink its approach to addressing affordability. Industry members and regulators need to start a conversation about whether the current affordability framework is fit for purpose in 2021 and beyond.

Affordability and consumer protection – a fresh approach

More flexibility needed in payment plans

Payment plans can penalise customers whose personal circumstances are uncertain from day to day or week to week. A retailer will often cancel a payment plan after a single missed payment or underpayment – even if the customer has continued to make regular payments and has taken steps to reduce their energy consumption.

Industry discussion point:

Industry discussion point:

A revised affordability framework could provide customers experiencing financial vulnerability with increased flexibility by allowing them to pay smaller amounts, and to catch up, without failing or cancelling a payment plan. The framework could focus on how much a customer contributes over a period of time (the financial objective) rather than simply making a set payment at a particular date. Customers who have experienced a sudden change in income could be allowed to make no payments for a short period of time, provided they engage with their retailer.

Industry standard required for estimating usage for payment plans

Retailers are required to balance customer capacity to pay, usage and arrears before offering a payment plan. The methodology used to estimate future usage usually takes into account consumption for the past 12 months. Where customers have taken steps to reduce their consumption, this is often not taken into account. As a result, customers are offered, and accept, a payment plan that is beyond their means.

Industry discussion point:

Industry discussion point:

The NERR, or the AER’s Sustainable Payment Plan Framework, could be updated to include industry guidance on how to provide more flexible consumption estimates for customers negotiating payment plans. This would improve the affordability of payment plans across the National Electricity Market.

Industry standard needed for payment plan cancellations

The retailer obligation to offer two payment plans to customers experiencing vulnerability is only one step in the debt collection cycle established through the NERR. To progress through the debt cycle, retailers will often notify a customer when a payment plan instalment has been missed, and prescribe a time for the customer to respond. If a customer contacts their retailer beyond that timeframe with good reason, their payment plan has often already been cancelled, the retailer has advanced the debt collection process, and there’s no way back.

Industry discussion point:

Industry discussion point:

The framework could be revised to establish a standard process where customers are notified of a failed payment plan and given a longer fixed time period to engage with their retailer to rectify the missed payments. This would enable customers to advise their retailer about changed circumstances before the plan is cancelled.

Fast-tracking of debt collection by auto-generated payment plans needs to stop

Retailer automated billing and collection systems can escalate the debt collection cycle and significantly impact a customer’s ability to access financial assistance in the future. For example, if a retailer has cancelled a customer’s payment plan due to a missed or underpayment, and a new payment plan is auto-generated, the customer is notified but isn’t always given the chance to agree to the new automated plan. Any associated correspondence from the retailer is based on a ‘must approach’ rather than a ‘times are tough, we’re here to help approach’. If the customer then misses a payment, they’ve failed two automated payment plans and the debt collection cycle is instantly escalated.

Industry discussion point:

Industry discussion point:

This could be addressed by regulating the circumstances where retailers use automated payment plans, in order to ensure customers avoid the negative repercussions. Combining the efficiency of automation, with good retailer/customer communication that also offers solutions and recognition for customers who engage, could be more effective.

”Two strikes and you’re out” rule and disconnection/reconnection

The rules for disconnection and reconnection are designed to manage customers who will not pay and/or are not engaging with their retailer.

Customers experiencing financial distress are likely to be managing multiple overdue accounts and repayments for a range of essential services, and need to prioritise which bills can be paid each week. This can limit their ability to engage with their retailer within tight timeframes. In order to be reconnected customers are often required to make large upfront payments or commit to unaffordable payment plans. These rules are appropriate for customers who simply refuse to pay, but for many customers experiencing financial vulnerability, disconnection and reconnection should be an opportunity for engagement, not a barrier between customers and the financial assistance they need.

The collection cycle established within the NERR currently restricts customer access to further payment assistance if they have failed two payment plans in the previous 12 months. This “two strikes and you’re out” rule is the turning point where some customers move from situational affordability challenges to long term financial distress, especially when retailers no longer negotiate with them due to two previously failed payment plans.

This occurs in different circumstances including where customers have made smaller payments than requested (what they can afford at the time); where customers did not engage with the retailer; and where retailers increased the payment plan amount to an unmanageable level for the customer. The “two strikes and you’re out” rule does not account for whether the failed payment plans were actually affordable for the customer in the first place. Critically, the application of this rule often renders customers ineligible for re-entry into retailer affordability programs.

Industry discussion point:

Industry discussion point:

Disconnection and reconnection should not block customers experiencing financial vulnerability from accessing further payment assistance. However, tough rules for customers who can, but refuse to pay, provided this is fully assessed by retailers, are valid. Increased focus on customer engagement before disconnection, as adopted by some retailers during COVID-19, could play a critical role in setting customers up for payment plan success.

The one-size-fits-all “two strikes and you’re out” rule for payment plans – as currently applied – is not fit for purpose. A revised flexible payment plan framework that encourages customers to engage with their retailer when their circumstances change would reduce the number of some retailer disconnections/reconnections. This would also prevent increased debt due to associated fees, and reduce customer reliance on pay-day lenders to gain reconnection; all of which leads to further financial distress.

Clarification of the schedule of steps that retailers should take to disconnect customers for non-payment, after a medium-term payment plan is cancelled, could also improve outcomes.

Stop ‘shoehorning’ customers with long-term affordability challenges

Pre-COVID, 13% of Australian’s were living on or under the poverty line3; many, but not all, experiencing complex ongoing financial distress. These customers are shoehorned into the current payment plan and affordability framework.

The NECF affordability framework was designed for customers experiencing short to medium term financial vulnerability, but it doesn’t work for customers who are unable to afford their ongoing energy consumption. Over a third of customers on ‘affordable’ payment plans have not been able to meet their ongoing energy usage costs. Keeping some customers, and their families, connected means they will incur an unpaid increasing energy debt despite many of these customers paying what they can afford.

Industry discussion point:

Industry discussion point:

Customers experiencing complex, long-term financial distress are further marginalised by the current payment plan framework and this is often a disincentive to make further payments. As a result, more and more of these customers are labelled as ‘won’t pay’ rather than ‘can’t pay’ by some retailers. Structural change to current energy affordability frameworks alone will not make energy more affordable for these customers. Instead, the issue needs to be addressed collectively and collaboratively.

The energy sector, regulators, state and commonwealth governments, energy ombudsman and peak bodies such as Financial Counselling Australia need to collectively consider and identify the benefits of a system that provides affordable energy to customers experiencing long-term financial vulnerability. Initially, all market participants, including networks and generators, could contribute to the development of an industry led solution. It’s effective implementation would require a solution for past customer debt to be put aside in order to pave a success path for the future. This in turn could encourage governments and essential service related industries, not only energy, to consider their broader social responsibilities to Australians who, without poverty eradication, will always find essential services unaffordable.

- AER, Annual retail markets report 2019-20 Charts and Tables

- AER, Annual Retail Markets Report 2019-20, November 2020, pp 4, 87

- Australian Council of Social Services

Why do we respond to systemic issues?

- National Energy Retail Law (NERL): establishes that an Energy Ombudsman must identify and advise on systemic issues as a means of preventing complaints and disputes.

- EWON’s Constitution: requires us to assist in the reduction and avoidance of complaints

- EWON’s Charter: we must identify possible systemic issues, whether systemic to a particular member or systemic to a group or type of Members, and where appropriate investigate these.

Systemic issues linked to affordability

Some of the most critical systemic issues work we have done over the last seven years has focused on groups of customers with affordability problems who cannot access the financial assistance they need. These are difficult issues to address. We must balance trying to keep the most vulnerable customers connected against the minimum obligations placed on energy retailers by the National Energy Customer Framework (NECF). Resolving these important systemic issues involves:

- helping to change the internal culture of our member organisations

- raising the standard of good industry practice

- bringing the regulatory stakeholders together to obtain the best understanding we can about how each element of the affordability framework fits together.

Our complaints data informs the contents of this paper – case studies for each issue raised can be made available to support both the views outlined, and the industry discussion points.

For queries about policy issues raised in Spotlight On, contact Rory Campbell. For media queries contact Fran Strachan.